How will covid-19 impact the property market? Part 2

In the previous blog we discussed how Covid-19 has changed the story for 2020. In part 2 we will cover what the buyers and sellers should do despite covid-19. Who will be the winners in the current market?

Should you buy a property now?

The Federal Government has announced a construction/renovation grant of $25,000 for building or renovating homes. This is designed for home owners only.

It will be interesting to see how this will play and whether the South Australian first home owners (FHO) grant of $15,000 will continue?

In the housing market, in March there was a pullback by buyers (both overseas and local buyers) and that took the momentum out of the market. However according to Corelogic Home Value Index results for May, although nationally the dwelling values index was down over the month, Adelaide and Canberra results indicated an increase of 0.4% and 0.5% respectively, in home value.

The initial signs are that the property market is set for more stable return than may have been predicted. We have witnessed the steady signs in new listings and increase in number of enquiries and increase in number of people attending inspections.

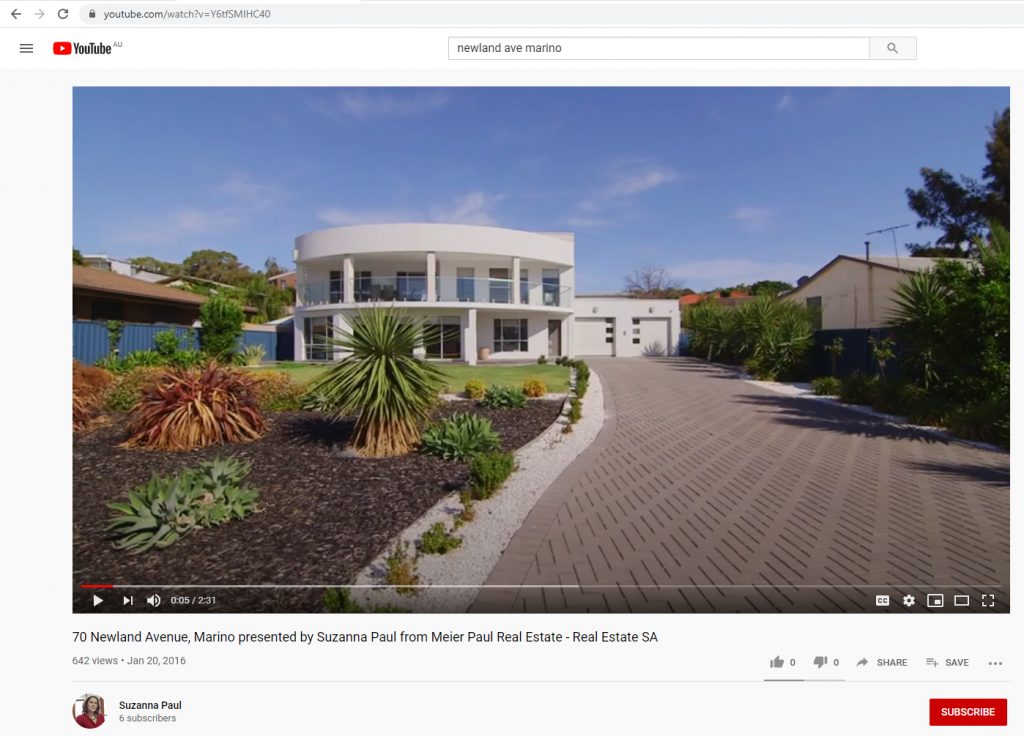

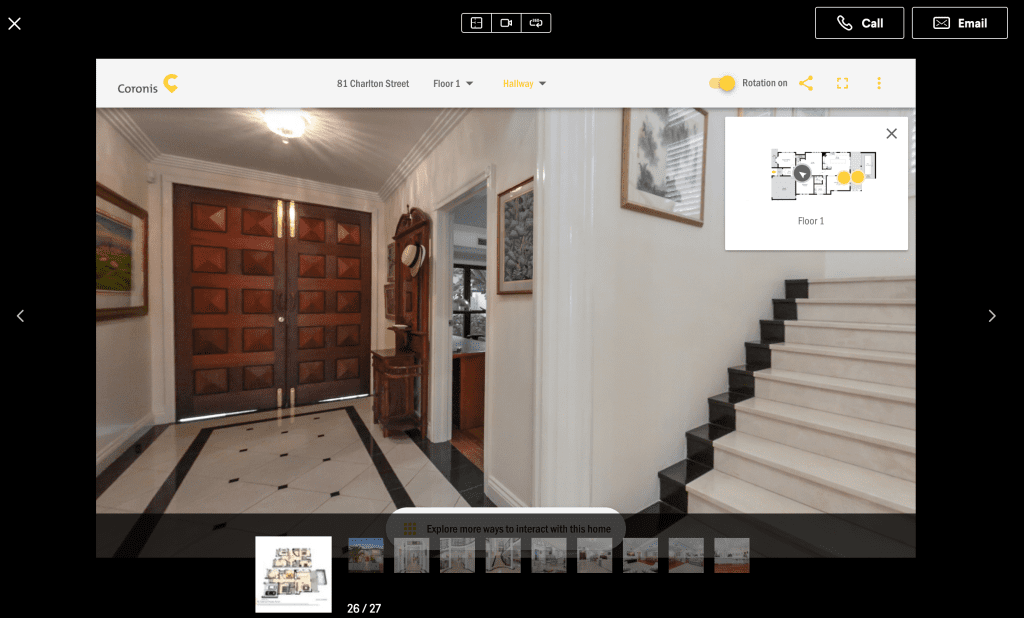

In this environment, buyers who are in secure jobs are in an improved position because the overall market is weaker. Covid-19 will take a group of buyers out of the market – those risk averse buyers who may be adopting a wait-and-see approach or who are simply unable to buy due to reduced income. That gives the buyers who are ready and willing to buy, opportunity to negotiate due to lower level of competition. Buyers are spending more time searching online and inspecting homes via videos and virtual tours before they attend open inspections.

Property investors could be in a better position to buy (to create or add to an existing property portfolio) but temporary weakness in rents is a real factor and investors should speak to their financial advisors/accountants and find out if they should buy positively/neutrally or negatively geared properties. Every investor will have a different situation and the tax implication may be different.

Should you sell now?

If you’re a seller in the eastern states, you may have noticed things are going to be weaker. In South Australia, we have traditionally had steady growth and may not experience the lowering of prices as much.

There will still be people who need to sell. This could take longer due to lower numbers of people attending open inspections but there will still be properties transacting in this market.

In real estate the three D’s for sale, regardless of market conditions, will still prevail and they include, debt, death or divorce.

The sellers who have flexibility may have deferred and are waiting for the market to stabilise. That has helped to cushion price falls but also reduce the supply.

According to realestate.com.au the search activity for properties for sale has increased by 62%. Digital Inspection video views have increased by 104% since March, suggesting buyers are active and want video and virtual tours. These marketing tools have been more effective than ever before and will be a necessary for future.

Those potential sellers who are upsizing or downsizing (or as we call it “right sizing”) would be better off listing now as there is limited stock and buyers have less options and would be willing to pay more. Traditionally Spring time is when sellers look to advertise and sell their homes but with job keepers/job seekers packages due to cease by September it may be better to look to sell prior to that time.

In summary, research, take your time and talk to an experienced local real estate agent for advice.